In this approach, we’re checking all possible values of  . Hence, we call this the brute force approach.

. Hence, we call this the brute force approach.

We iterate over all possible pairs  and

and  , such that

, such that  always starts from

always starts from  and moves forward. The index

and moves forward. The index  represents the day we buy the product. On the other hand, the index

represents the day we buy the product. On the other hand, the index  represents the day we sell the product.

represents the day we sell the product.

Therefore,  starts from

starts from  and moves forward because we can’t sell a product if we haven’t bought it yet.

and moves forward because we can’t sell a product if we haven’t bought it yet.

For each pair ( ,

,  ), we check whether we can get a better profit from the already found profit. If so, we update the stored profit. Also, we store the day we decided to buy the product and the day we decided to sell it.

), we check whether we can get a better profit from the already found profit. If so, we update the stored profit. Also, we store the day we decided to buy the product and the day we decided to sell it.

In the end, we return the stored answer and both indexes of the days to buy and sell the product in.

The complexity of the naive approach is  , where

, where  is the number of days.

is the number of days.

4. Dynamic Programming Approach

Let’s try to improve our naive approach.

4.1. General Idea

In the naive approach, we tried all possible pairs of days  and

and  . However, if we think deeply, we can see that when we decide to sell a product on the day

. However, if we think deeply, we can see that when we decide to sell a product on the day  , it’s always optimal to choose the smallest price in days

, it’s always optimal to choose the smallest price in days ![Rendered by QuickLaTeX.com [1..j]](/wp-content/ql-cache/quicklatex.com-830aefc8e2b4327559f964939088f3bf_l3.svg) to buy the product in before selling it.

to buy the product in before selling it.

So, in each step, we need to calculate the value  , which stores the smallest value before, and including, the current index

, which stores the smallest value before, and including, the current index  . Let’s use dynamic programming to calculate the values

. Let’s use dynamic programming to calculate the values  quickly.

quickly.

Suppose we calculated the lowest price values before the index  , and we need to calculate the value when we reached the index

, and we need to calculate the value when we reached the index  . The first solution would be to iterate over all the values in range

. The first solution would be to iterate over all the values in range ![Rendered by QuickLaTeX.com [1, j]](/wp-content/ql-cache/quicklatex.com-4cd88b058ff79068804cb8af70676f37_l3.svg) and take the minimum value among them.

and take the minimum value among them.

However, we can notice that the previous value of  represents the range

represents the range ![Rendered by QuickLaTeX.com [1, j - 1]](/wp-content/ql-cache/quicklatex.com-1e3a88ccc6aee073fb86c8a919888ff6_l3.svg) . Since the current range is

. Since the current range is ![Rendered by QuickLaTeX.com [1, j]](/wp-content/ql-cache/quicklatex.com-4cd88b058ff79068804cb8af70676f37_l3.svg) , we can see that it differs only by the index

, we can see that it differs only by the index  from the previous range.

from the previous range.

Thus, we can simply calculate the minimum value in range ![Rendered by QuickLaTeX.com [1, j]](/wp-content/ql-cache/quicklatex.com-4cd88b058ff79068804cb8af70676f37_l3.svg) by taking the minimum between the previous value of

by taking the minimum between the previous value of  and

and ![Rendered by QuickLaTeX.com P[j]](/wp-content/ql-cache/quicklatex.com-1597e1bb3bcf863ab458ee4d477281d6_l3.svg) .

.

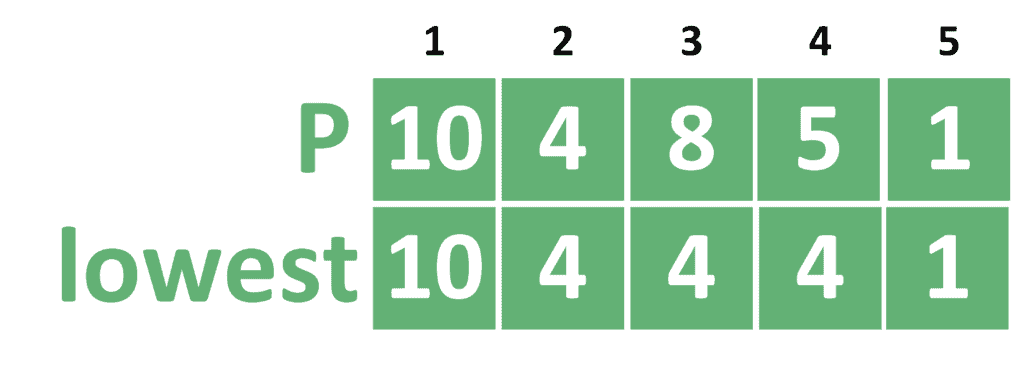

Let’s take the following example to explain the idea better:

First of all, we assign ![Rendered by QuickLaTeX.com lowest = P[1] = 10](/wp-content/ql-cache/quicklatex.com-1ec9516493af6d37dee60d8c7e82de40_l3.svg) because we don’t have a previous range yet. After that, for each index

because we don’t have a previous range yet. After that, for each index  we take the minimum between the previous value of

we take the minimum between the previous value of  and

and ![Rendered by QuickLaTeX.com P[j]](/wp-content/ql-cache/quicklatex.com-1597e1bb3bcf863ab458ee4d477281d6_l3.svg) .

.

Now that we showed how to calculate the  values, we can use it to improve the naive approach.

values, we can use it to improve the naive approach.

4.2. Implementation

Take a look at the implementation of the dynamic programming approach:

algorithm MaxSingleSellProfitDP(P, n):

// INPUT

// P = the prices array

// n = the size of the prices array

// OUTPUT

// The maximum single-sell profit, buy day, and sell day

indexOfLowest <- 0

Lowest <- P[0]

Answer <- 0

buyDay <- 0

sellDay <- 0

for j <- 1 to n:

if P[j] <= Lowest:

indexOfLowest <- j

Lowest <- P[j]

if Answer <= P[j] - Lowest:

Answer <- P[j] - Lowest

buyDay <- indexOfLowest

sellDay <- j

return Answer, buyDay, sellDay

Instead of calculating an entire array  , we’ll just keep a variable named

, we’ll just keep a variable named  , that stores the minimum value so far.

, that stores the minimum value so far.

In each step, we check if the current value is smaller than the lowest price so far. If so, we update the value of  and

and  . Note that we’ll store the index of the minimum value to be able to determine the day that we should buy the product in.

. Note that we’ll store the index of the minimum value to be able to determine the day that we should buy the product in.

After that, we check whether the current selling day with the lowest buying day gives a better solution than the stored one. If so, we store the profit we get as the best one so far. Also, we’ll store the index  as the buying day and index

as the buying day and index  as the selling day.

as the selling day.

Finally, we return the stored answer and both indexes of the buying and selling days.

The complexity of this approach is  , where

, where  is the number of days.

is the number of days.

5. Conclusion

In this tutorial, we explained the problem of finding the maximum single-sell profit from an array of prices. In the beginning, we presented the naive approach. Then, we showed how to improve it to obtain a dynamic programming solution.

days. The price of the ith day is denoted as

. Hence, we’re given an array called

of size

.

, such that

.